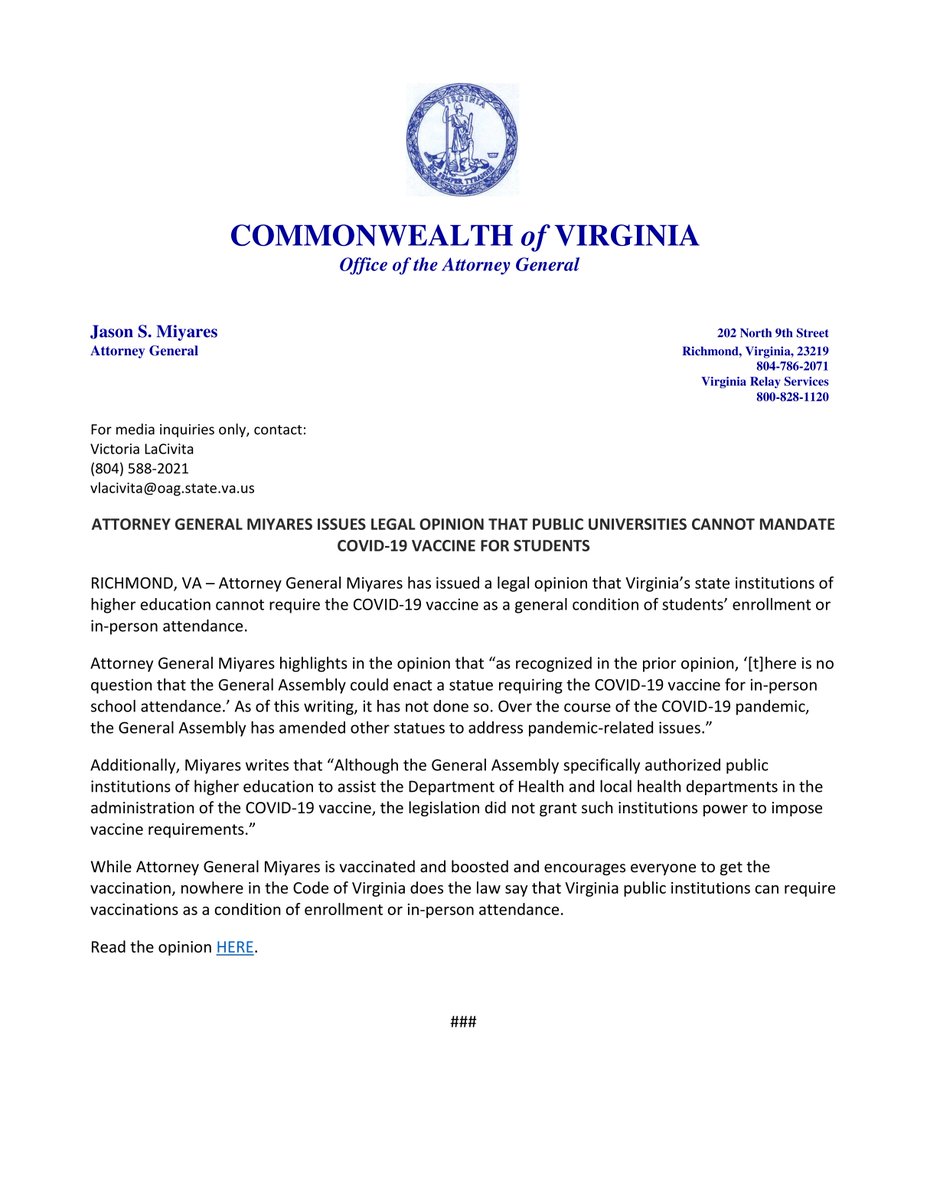

richmond property tax inquiry

Government Websites by CivicPlus. The 10 late payment penalty is applied December 6 th.

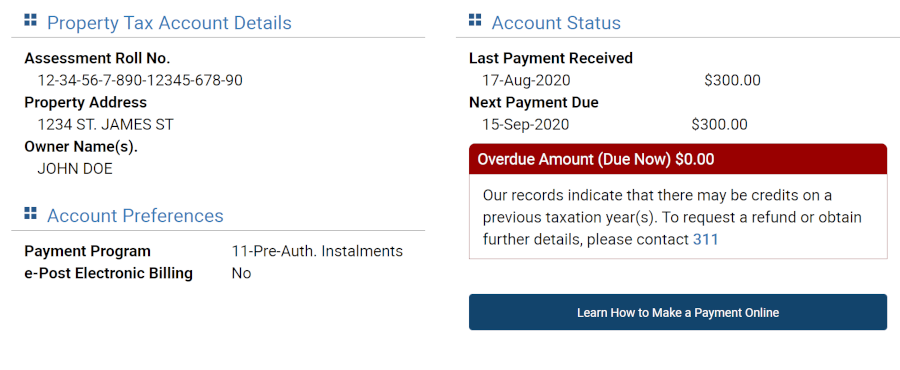

About Your Tax Bill City Of Richmond Hill

Beginning January 31 2021 interest on unpaid taxes will be applied monthly.

. Personal Property Taxes are billed once a year with a December 5 th due date. The fee will appear as a charge from Fort Bend County - GovPay Fee. Visit our Property Inquiry application.

Obtain a free uncertified Property Report on any Richmond property. The Richmond County Tax Department consists of three departments that are responsible for providing customer service to the tax payers of Richmond County. All property owners in Richmond Hill must pay their property taxes.

Expert Results for Free. Property Inquiry The report will include. McHenry County Property Tax Inquiry.

A convenience fee of 225 or a minimum fee of 100 for credit card and debit card payments will appear as a separate transaction on your credit card bill. The City Assessor determines the FMV of over 70000 real property parcels each year. These agencies provide their required tax rates and the City collects the taxes on their behalf.

Your annual property taxes collected by the City of Richmond funds municipal services and other taxing agencies such as the Province of BC School Tax TransLink BC Assessment Authority Metro Vancouver and the Municipal Finance Authority. Governmental Operations Standing Committee Meeting - February 23 2022 at 200 pm. See Property Records Tax Titles Owner Info More.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Ad Just Enter your Zip Code for Property Tax Records in your Area. Do not enter information in all the fields.

April 7 2021 admin. Real Estate Property Tax - Jackson County Mo. Chrome is the recommended desktop browser for this site.

Property tax inquiry richmond. There is no convenience fee for eCheck payments. Inside Assessor of Real Estate.

The results of a successful search will provide the user with information including assessment details land data service. The Tax Administrator oversees the entire department to ensure that all tax law is being followed in. Pay Personal Property Taxes.

Welcome to the My Property Account online access for the City of Richmond. Late payment penalties will apply to 2021 tax instalments. To pay your 2019 or newer property taxes online visit the Ray County Collectors website.

When searching choose only one of the listed criteria. 815 am to 500 pm monday to friday. Property value 100000 Property Value 100 1000 1000 x 120 tax rate 1200 real estate tax.

The City of Richmond is located south of Vancouver in the Metro Vancouver Regional District and is home to over 198K residents. In case you missed it the link opens in a new tab of your browser. Order Tax Certificates Tax Certificates are conveniently available online through.

Senior Citizen Property Tax Deferral. 30 Richmond News 1600 Colorado Ave Richmond VA. Click here for council information members legislation meetings laws charter and more.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established by Richmond City Council. Gross taxes levied. To search for tax information you may search by the 10 digit parcel number last name of property owner or site address.

Application deadline extended for citys Triple A Business Assistance Program for small businesses. Richmond real estate prices have not changed significantly from November 2019 to November 2020 and the average price of a house in Richmond is 972K. Just Enter Your Zip for Free Instant Results.

Each office is reflective of the North Carolina General Statues that administers property taxation in North Carolina. Personal Property Registration Form An ANNUAL filing is required on all. Search Any Address 2.

City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Personal Property Taxes Personal Property taxes are billed annually with a due date of December 5 th. Public Information Advisory - February 23 2022 Special Meeting - Decennial Voter District Redistricting.

City of Richmond - My Property Account. Assessed value of the property. Richmond property tax inquiry.

Get In-Depth Property Tax Data In Minutes. City of Richmond Real Estate Search Program. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

Richmond County Assessors Website Report Link httpswwwaugustagagov742Tax-Assessor Visit the Richmond County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records. Please contact the Commissioner of Revenue at 804-333-3722 if you have a question about your assessment. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

Start Your Homeowner Search Today. IE is not supported. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Interest is assessed as of January 1 st at a rate of 10 per year. Search Any Address 2. My Property Account is an online profile that gives you secure access to information regarding your City of Richmond accounts such as Utility Billing Dog Licences and Property Taxes - 24 hours a day 7 days a week.

If you do not have an account click here to. VA 23220 Zillow City Of Richmond Property Tax Phone Number Property Walls Richmond property taxes due July 2 but penalties deferred to Sept. See Property Records Deeds Owner Info Much More.

Pay Personal Property Taxes in the City of Richmond Virginia using this service. Offered by City of Richmond Virginia. Richmond Property Tax Calculator 2021.

Easily Find Property Tax Records Online. All taxpayers with an outstanding balance of 10 or more will receive a reminder notice early in December 2020. You can search for any account whose property taxes are collected by.

All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer. To search for tax information you may search by the 10 digit parcel number last name of property owner or site address.

Josh Fischman Joshfischman Twitter

About Your Tax Bill City Of Richmond Hill

Toronto Property Tax 2021 Calculator Rates Wowa Ca

Municipal Property Assessment Mpac City Of Richmond Hill

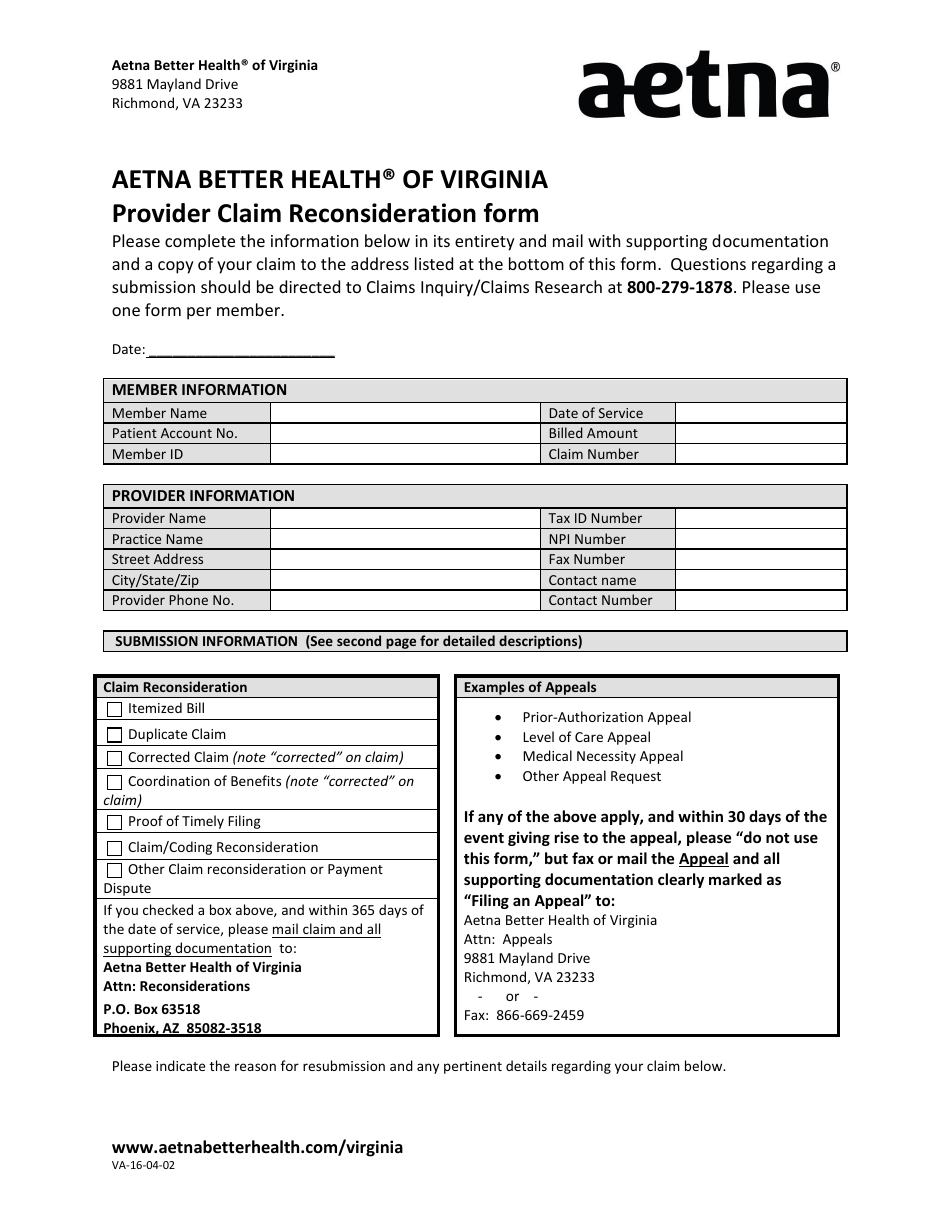

Form Va 16 04 02 Download Printable Pdf Or Fill Online Provider Claim Reconsideration Aetna Virginia Templateroller

Joe Dipaola Home Community News Newsletters Videos Photos About Joe Dipaola E News Registration Who Does What In York Region Richmond Hill Parks And Trails Guide Enjoy The Hundreds Of Kilometers Of Trails Great Parks And Unique Lakes In

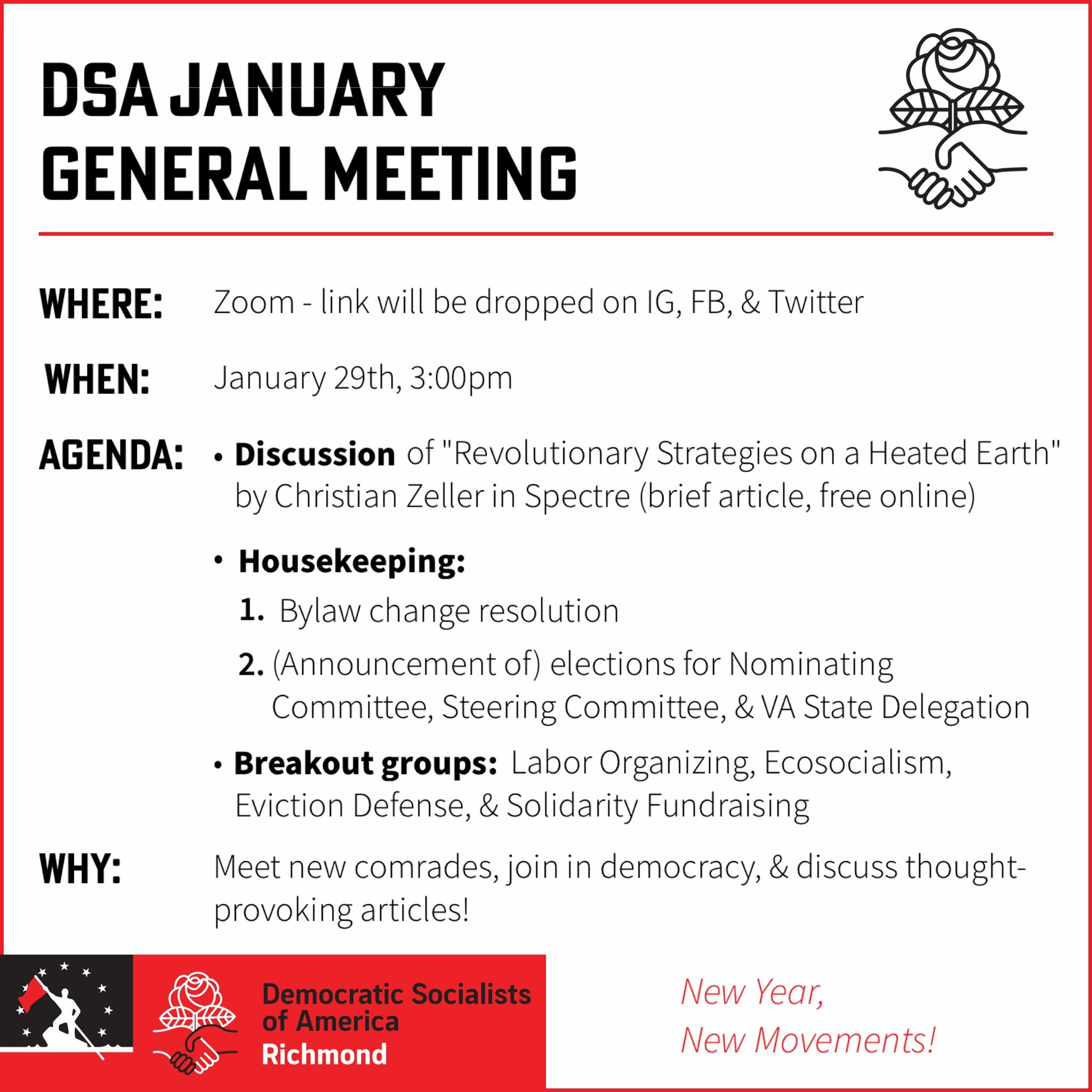

Richmond Dsa Dsarichmond Twitter

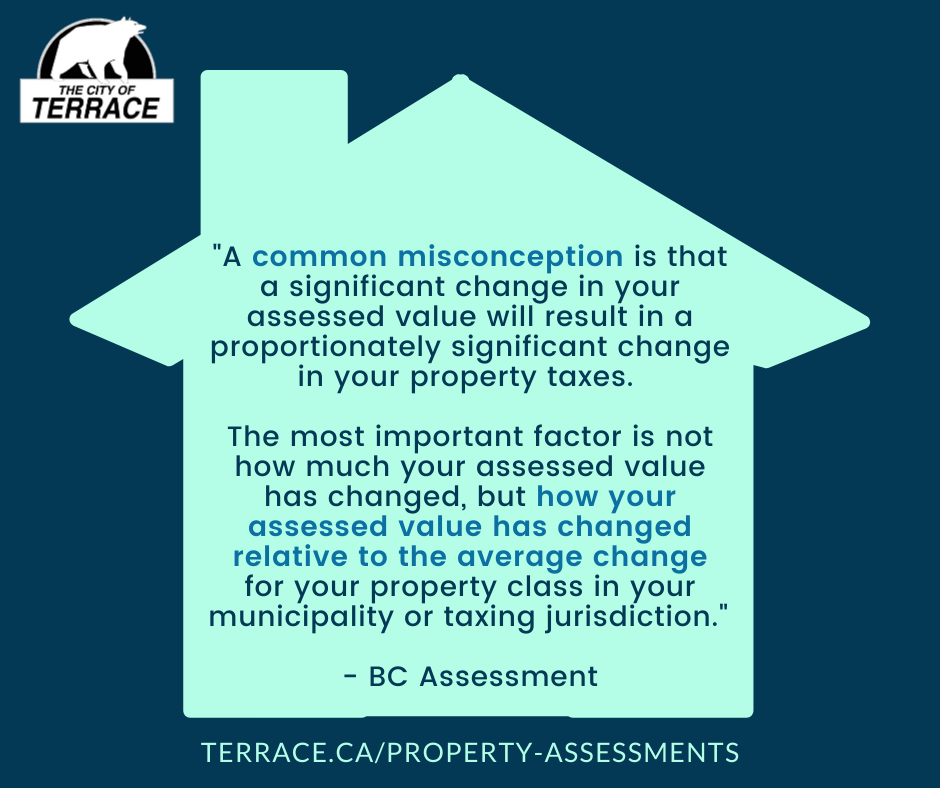

Property Assessments City Of Terrace

Residential Property Tax Calculator

Tax Crime Investigation Criminal Tax Cases Tax Notes

About Your Tax Bill City Of Richmond Hill

Inquiry Payment Counters City Of Toronto

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Delta Property Tax 2021 Calculator Rates Wowa Ca