nd tax commissioner forms

Download Print e-File with TurboTax. For the fastest refund - use Direct Deposit - see page 1 for more information.

About The North Dakota Office Of State Tax Commissioner

Schedule ND-1UT - Underpayment of Estimated Individual Income Tax.

. You may determine if you need to pay estimated tax to North Dakota using Form ND-1ES Estimated Income Tax Individuals. North Dakota Office of State Tax Commissioner at httpwwwndgovtax. Ryan Rauschenberger Tax Commissioner 2015 Partnership Income Tax Form 58 Includes.

We last updated North Dakota Schedule ND-1NR in February 2022 from the North Dakota Office of State Tax Commissioner. Fill in the amount of the North Dakota income tax withheld on lines 28 30 31 and 34. Schedule FACT Schedule K Schedule KP Schedule K-1 Dear Taxpayer Form 58 the North Dakota Partnership Income Tax Return may be filed electronically through the Modernized E-File MeF system.

444855 264 of amount over 233750 458350. Tax Year Beginning mmddyyyy. 1037799 290 of amount over 458350 2022 Form ND-1ES SFN 28709 12-2021 Page 3 Write Call Office of State Tax Commissioner 600 E.

ND State Tax Commissioner 2020. With the launch of the new website also comes the release of the 2021 North Dakota income tax booklets and income tax forms and the 2022 income tax withholding tables. Ryan Rauschenberger Tax Commissioner 2014 Partnership Income Tax Form 58 Includes.

ST - Sales Use and Gross Receipts Tax Form North Dakota Office of State Tax Commissioner I declare that this return has been examined by me and to the best of my knowledge and belief is a true correct and complete return. The 2021 North Dakota Legislature created a tax relief income tax credit for. You may be required to pay estimated income tax to North Dakota if you are required to pay federal estimated income tax and you expect your North Dakota net tax liability to be more than 1000.

Schedule ND1-PG - Planned Gift Tax Credit. Married filing separately 4. Account Number Due Date of Return Ex.

MMDDYYYY Amount of payment by check Mail entire page to. FORM ND-1 INDIVIDUAL INCOME TAX RETURN NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER 2019 SFN 28702 12-2019 AB 16 S5 9. If you are required to pay estimated income tax to North.

2021 Authorization to Disclose Tax Information Designate a Representative. Increased accuracy - especially during. 20 rows Free printable and fillable 2021 North Dakota Form ND-1 and 2021 North Dakota.

FORM 306 - INCOME TAX WITHHOLDING RETURN NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER SFN 28229 3-2019 A Fill in this circle if this is an amended return. 127 Bismarck ND 58505-0599 Questions. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the North Dakota government. Schedule ND-1CS - Calculation of Tax proceeds from Sale of Income Tax Credit. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed.

North Dakota Office of State Tax Commissioner. Ndgov Cory Fong Tax Commissioner NNoticeotice Sales Tax Request For Refund - Canadian Resident May 5 2009 In recent months the Tax Department has received a considerable number of sales tax refund. Receive your refund quicker.

Estimated tax paid on 2021 Forms 38-ES and 38-EXT plus an overpayment if any applied from the 2020 return 9 10. Schedule FACT Schedule K Schedule KP Schedule K-1 Dear Taxpayer Form 58 the North Dakota Partnership Income Tax Return may be filed electronically through the Modernized E-File MeF system. 701-328-1243 If speech or hearing impaired call us through Relay North Dakota at 1-800-366-6888.

File Form ND-1 with a copy of your federal return and Form W-2s showing North Dakota income tax withholding. See page 16 of instructions IIT. Married filing jointly 3.

Download Print e-File with TurboTax. North Dakota Office of State Tax Commissioner at httpwwwndgovtax Form 24757 is a North Dakota Other form. Form ND-1ES - 2022 Estimated Individual Income Tax.

North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD. Consider the benefi ts. Schedule ND-1FC - Family Member Care Credit.

Form 58 is a North Dakota Corporate Income Tax form. If taxpayers need help locating forms they can call 701-328-1243. Head of household 5.

FORM 38-PV FIDUCIARY RETURN PAYMENT VOUCHER. Disclosure authorization-I authorize the ND Office of State Tax Commissioner to discuss this return with the paid preparer identified below. OFFICE OF STATE TAX COMMISSIONER.

Wednesday December 29 2021 - 0100 pm. Engineering and Materials Testing. 1099-G consent-I agree to obtain Form 1099-G electronically at wwwndgovtax.

North Dakota Office of State Tax Commissioner PO Box 5624 Bismarck ND 58506-5624 WTH. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability. Download Print e-File with TurboTax.

Office of State Tax Commissioner PO Box 5623 Bismarck ND 58506-5623. Also enter MN or MT whichever applies in the space under State Leave line D and lines 1 through 27 blank. Fill in the circles that apply.

Tax Commissioner Cory Fong Tax Commissioner Form ND-EZ Form ND-1 North Dakota Offi ce of State Tax Commissioner 2009 Individual Income Tax Not sure if you should E-File. Engineering and Materials Testing. Please Do Not Write In This Space Mail to.

Income tax withholding tables are also available on the new site at wwwtaxndgovIncomeTaxWithholding. North Dakota income tax withheld from wages and other payments taxable to estate or trust Attach Form W-2 Form 1099 and North Dakota Schedule K-1 8 9. MeF allows the North Dakota and federal partnership returns to be.

SFN 28749 12-2020 Name Of Fiduciary Detach here and mail with payment FIDUCIARY RETURN PAYMENT VOUCHER. Income tax booklets and forms can be found on the new website at wwwtaxndgovforms. MeF allows the North Dakota and federal partnership returns to be.

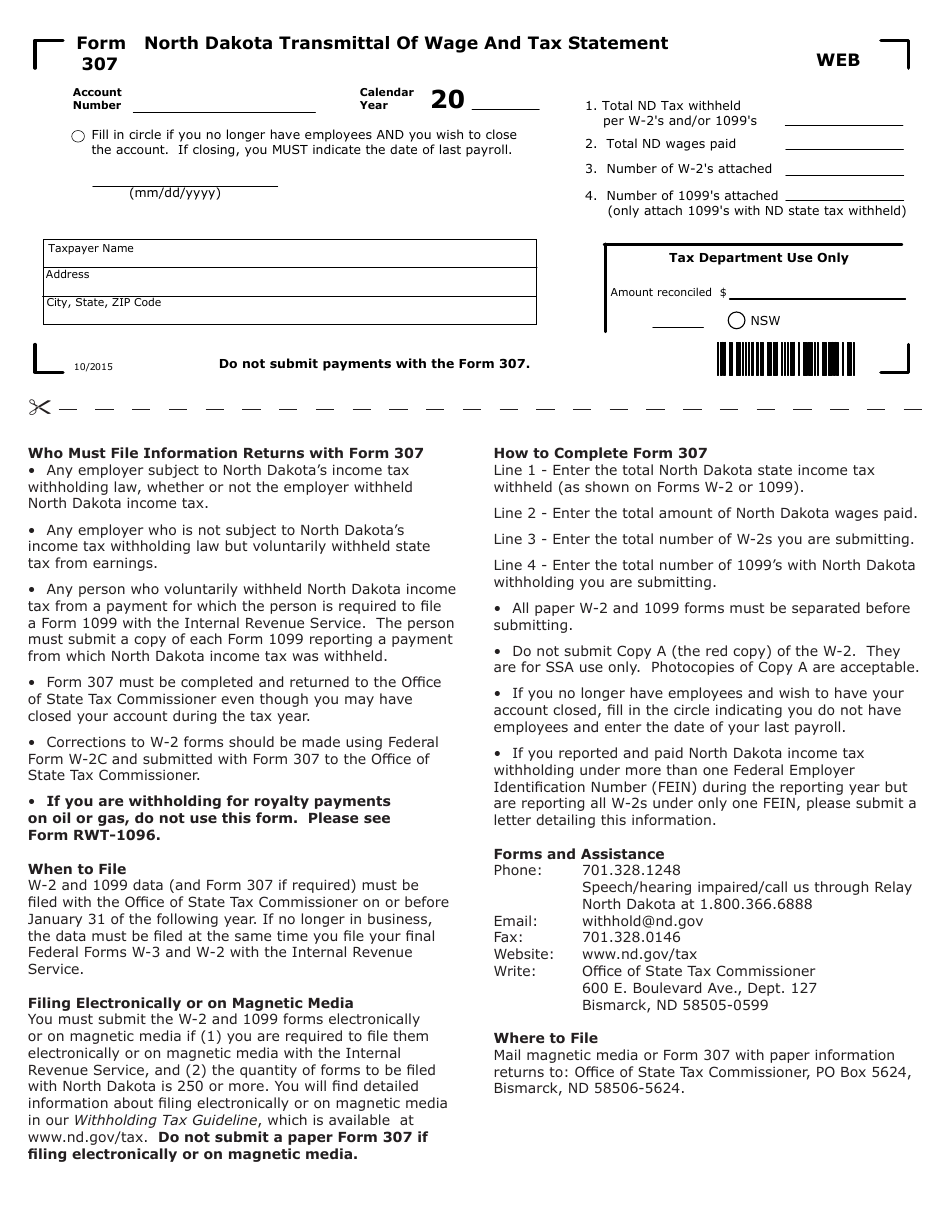

2021 Application to Obtain Contractors Request for Clearance. 2021 North Dakota Transmittal Of Wage And Tax Statement. SFN 28749 12-2020 Form 38.

Form ND-1EXT - 2021 Extension Payment Form. North Dakota Office of State Tax Commissioner Claim for Refund Local Sales Tax Paid Beyond Maximum Tax not to be used for incentive exem ptions or to amend a sales tax return 21944 Form revised 0116 Name Social Security Number or Federal Employer Identification Number Address City Zip Code.

North Dakota Office Of State Tax Commissioner Facebook

Ndtax Department Ndtaxdepartment Twitter

Tax2 Admit Card Result Tax2 Teletalk Com Bd Job Circular Exam Results Online Checks

Form 307 Download Fillable Pdf Or Fill Online North Dakota Transmittal Of Wage And Tax Statement North Dakota Templateroller

Income Tax Update Special Session 2021

How To Avoid Tax Refund Delays In 2022 Boundless

/cloudfront-us-east-1.images.arcpublishing.com/gray/X3WS47RCPVERVMOAWGETLKQHKA.png)

Nd Tax Website Revamped In Time For Tax Season

What You Should Know About Same Sex Marriage Tax Benefits

North Dakota Office Of State Tax Commissioner Facebook

North Dakota Office Of State Tax Commissioner Facebook

Pin By Zecurin Insurance On Insurance Marketplace Insurance 10 Things Health

Process Server District Attorney Richmond County Ny Fire Badge Police Badge Process Server

Irs Warns Some Taxpayers May Have Received Incorrect Child Tax Credit Letter 6419 Cbs News

Flames Games Postponed At Least Through Dec 16 Due To Covid 19 Reuters